In this edition, we’re giving you a rundown on Sei Network; what it does, where it is on the development schedule, and more.

Blockchains like Sei and Monad are garnering more attention as ways to scale the EVM. This sentiment comes as Solana continues to see fast and nearly-feeless activity, while EVM chains like Avax, Arbitrum, and more have seen outages and delays recently.

Background on Sei Network

Price: ~$0.434

Marketcap: ~$1.6B

FDV: ~$4.3B

- Sei Network brands itself as ‘the fastest L1’

- The team behind Sei Network, based in San Francisco, has extensive experience and was inspired by the loss of trust in Robinhood during the GameStop situation.

- They aim to rebuild trust by creating a decentralized exchange (DEX) that operates similarly to centralized exchanges like Coinbase but with enhanced user trust.

- Jeff Feng, Co-Founder of Sei, says that Sei focuses on one problem in crypto; trust issues.

- By focusing on solving trust issues, they aim to provide users with a seamless experience while maintaining decentralization.

- Sei Network believes that the core value proposition of blockchains is the exchange of digital assets.

- They optimize every part of their layer one stack to create a fully decentralized DEX that operates similarly to centralized exchanges.

Sei Ecosystem

- The Sei ecosystem is in early production but contains some apps with proven use cases.

- Levana provides a fully collateralized perps platform, with a 3 stage $LVN airdrop program for users.

- Astroport is a liquidity hub for traders and LPs on cosmos, providing concentrated liquidity, stableswaps, and Uniswap constant product pools.

- UXD Protocol, a stablecoin protocol primarily used on Solana, will be integrating $UXD on the chain, providing a native stablecoin for the Sei network.

- Some of these apps, like Astroport and Levana, were initially built on Terra Luna, who needed to migrate to other chains in order to continue shipping their product.

Sei: Plans Ahead

- Sei’s focus on V2 and upcoming announcements demonstrates their commitment to shipping relevant updates.

- Sei has been actively expanding its presence and ecosystem in Asia since early 2023.

- This includes hiring local talent, translating documents, and building relationships, which have proven to be key strategies.

- Users in Asia are more active and less encumbered by regulatory uncertainties.

- The Sei foundation is organizing its first major event in Korea during Q1-Q2 as part of its increased focus on Asia.

- More and more protocols are realizing the potential of the Asian market and turning their sights towards the east.

- Injective ($INJ), which also is built upon the Cosmos SDK, has a large following in Asia. Thailand’s largest commercial bank has been a validator for $INJ since 2021, along with other large institutions in the South East Asia region.

- Astar, which brands itself as ‘Japan’s most popular smart contract platform’, is seeing increased attention and more exchange listings.

Sei V2: Parallelizing Ethereum

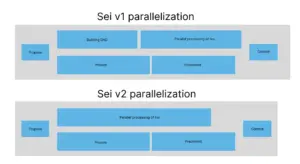

- Sei V2 is a major announcement proposing a parallelized EVM (Ethereum Virtual Machine). It combines Solana’s advancements with the ease of use and developer traction of EVM and Solidity.

Sei v1 vs Sei v2

- Sei V2 aims to provide a better-performing chain by leveraging the latest improvements in computing power.

- Users can now exchange assets more easily on Sei V2.

- The focus is on solving user problems and improving their ability to exchange assets seamlessly.

- In order for new protocols or applications to gain traction, they need publisher partners.

- Publishers can be centralized exchanges or layer-1 or layer-2 bridges.

- Ethereum is currently the biggest publisher in the crypto space, making it an attractive platform for developers to build on.

- To compete with Ethereum, Solana aims to become a better publisher partner by offering more benefits and opportunities for developers.